west virginia retirement taxes

The state income-tax deduction will. The first 2000 of annuities retirement allowances returns of contributions and any other benefit including survivorship benefits received under the West Virginia Public.

Taxes States With No State Income Tax States That Do Not Tax Military Retired Pay As Of 9 June 2016 Financial Management South Dakota New Hampshire

West Virginias highest income tax bracket is 65 and the lowest is 3.

. In addition employees are offered the voluntary opportunity to participate in the West Virginia Retirement Plus Program a supplemental retirement plan designed to provide an extra savings. Oregon taxes most retirement income at the top rate while allowing a credit of up to 7050 for retirement distributions. Starting with the 2020 tax year.

304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. In West Virginia the median property tax rate is 584 per 100000 of assessed home value. West Virginia Real Property Taxes.

Low Cost of Living 2. View your account details. West Virginia Property Tax Breaks for Retirees.

Retirement Income and Social Security Exemption. Virginia offers qualifying individuals ages 65 and older a subtraction that reduces the amount of their income subject to Virginia income tax. 4 Full Seasons Cons of Retiring in West Virginia 1.

CHARLESTON WV WOWKA recent survey conducted by Retirement Living found that West Virginia is the third-best state for retirement right behind Florida and Texas. Under the new law starting in 2022 Virginia is making up to 10000 in military retirement pay tax-free for those ages 55 and older. 4101 MacCorkle Avenue SE Charleston West Virginia 25304 Telephone 304 558-3570 or 800 654-4406 Nationwide Fax 304 957-7522 Email.

Medical Advisors log in here. West Virginia personal income tax law provides a modification reducing federal adjusted gross income for certain retirement income received from the WV State Police retirement system. West Virginia allows for a subtraction of up to 2000 of retirement income from West Virginia Teachers Retirement West Virginia Public Employees Retirement System or Federal.

Plenty of Outdoor Activities 3. If you were born on January 1 1939 or earlier you. Taxpayers over 65 may exclude the.

Table of Contents. Thanks in part to the advocacy campaign by AARP West Virginia Mountain Staters will enjoy a phaseout of a state tax on Social Security benefits. Use Self Service to.

Update your contact information. Missouri Montana Nebraska New Mexico Rhode Island Utah. Pros of Retiring in West Virginia 1.

The total amount of any benefit including. Teachers Retirement System West Virginia Public Employees Retirement System and Federal Retirement Systems Title 4 USC 111. If you have any questions concerning this Tax Calculator please call 304 558-3333 or 1-800-982-8297.

Continue to the Tax Calculator. Tax Information and Assistance. Marginal Income Tax Rates.

Virginia Retirement Tax Friendliness Smartasset

Which States Are Best For Retirement Financial Samurai

13 States That Tax Social Security Benefits Tax Foundation

West Virginia Is Third Best State For Retirement Survey Says Wboy Com

West Virginia State Veteran Benefits Military Com

Taxes After Retirement Tips For Keeping More Money

States That Don T Tax Retirement Income Personal Capital

5 Best States To Retire For Low Property Tax Rates Ira Financial Group

West Virginia Retirement Guide West Virginia Best Places To Retire Top Retirements

Is Social Security Taxable Complete Guide Tips Inside Social Security Offices

West Virginia House Passes Income Tax Cut Bill Wowk

24 States That Don T Tax Retirement Income

W Va House Oks Dropping Tax On Social Security Benefits

37 States That Don T Tax Social Security Benefits The Motley Fool

A Complete Guide To West Virginia Payroll Taxes

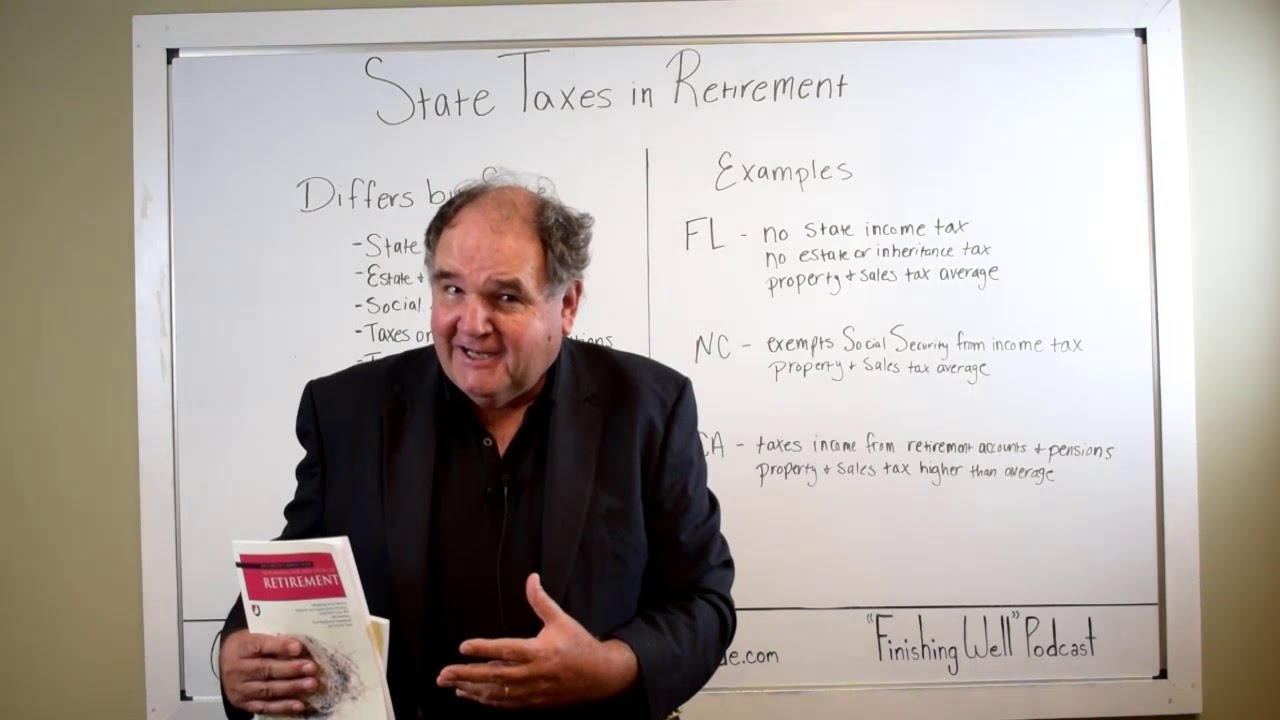

State By State Comparison Where Should You Retire